By Russell Powell, Senior Vice President, Economic & Planning Systems, Inc. (EPS)

Development impact fees (a.k.a., impact fees) are one of many infrastructure financing tools available to cities, counties, special districts, and school districts. Impact fees provide a funding mechanism for new public infrastructure and facilities required to serve new development in California communities. Development impact fees are not to be used to fund existing infrastructure deficiencies and are not intended to fund reconstruction of existing infrastructure currently serving existing development. This article describes how development impact fees are implemented, current challenges threatening impact fees, and best practices for special districts in implementing impact fees.

Overview

Special districts are allowed to charge and collect development impact fees, or development impact mitigation fees, under the Mitigation Fee Act (Government Code 66000, et seq.) [Mitigation Fee Act]. Such fees are imposed by public agencies to mitigate the costs of providing infrastructure and facility improvements needed to serve new development. Development impact fees are implemented to ensure that new development pays a proportionate share for infrastructure and facilities required to serve such new development. Special districts may consider and adopt development impact fees programs, but only public agencies with land use authority (such as cities and counties) may adopt and collect such fees. As such, in most instances, a special district will need to work with cities or counties that have land use authority over the territories of the special district.

Typically, development impact fees are more prevalent in areas of the state where significant new residential and nonresidential development is occurring. However, special districts in areas where growth is moderate may use development impact fees to provide incremental improvements to infrastructure and facilities that serve new residents or businesses.

Development impact fees may be used to construct water treatment and distribution facilities, wastewater treatment and collection facilities, parks, public facilities (such as fire stations), and to acquire land for public uses.

As with many current public infrastructure funding programs available to public agencies, the Mitigation Fee Act was enacted to offer local agencies an alternative local funding source for public infrastructure after the passage of Proposition 13. Economic development at the local level often requires the extension of public infrastructure and facilities to unoccupied lands to spur new growth in a community. With the passage of Proposition 13, the voters seemed to be telling their local leaders that all new growth should be paid for by those advocating for such new developments. As a result, for the last 40 years, the cost of most new development in California has been borne by new development. But this cost is necessarily also passed along to new residents in the form of increasing costs of housing.

Development impact fees enable local agencies to allocate the cost of building new infrastructure and facilities to new development equitably. When implementing a new or updated development impact fee, special districts should first identify all infrastructure and facilities that must be constructed to serve new development. Careful consideration needs to be given to the analysis of improvements required to serve new development compared to the costs of replacing aging infrastructure and facilities.

When establishing a development impact fee, the Mitigation Fee Act stipulates that special districts will need to:

- Identify the purpose of the fee.

- Identify how the fee is to be used.

- Determine how a reasonable relationship exists between the fee’s use and the type of development project on which the fee is imposed.

- Determine how a reasonable relationship exists between the need for the public facility and the type of development project on which the fee is imposed.

- Demonstrate a reasonable relationship between the amount of the fee and the cost of public facility or portion of public facility attributable to the development on which the fee is imposed.

In preparing to establish a development impact fee, the public agency needs to identify land use assumptions for growth areas in the special district. In identifying future growth areas, a district will be able to determine infrastructure or facility improvements required to serve the new development. To the extent a district has existing capacity to absorb new growth, a development impact fee may be established to fund the costs of “buying in” to an existing facility, or to help pay debt service for such facilities. Once established, a development impact fee also may be used to fund the annual costs of administering the fee program. Administrative costs would include accounting costs, all public reporting requirements, and the cost of implementing and updating the development impact fee periodically.

Development Impact Fee Nexus Study

A special district seeking to implement new or updated development impact fees must prepare, or have prepared, and Nexus Study which will demonstrate the nexus between the amount of the fees to be imposed and demonstrate the reasonable relationship between the amount of the fee and the cost of public facility or portion of public facility attributable to the development on which the fee is imposed. The Nexus Study should address the following topics:

- Identify Capital Improvements to be included in the Nexus Study fee analysis:

- Identify those facilities that specifically benefit new development.

- Identify those facilities that are intended to serve existing development.

- Develop costs for all Capital Improvements and allocate costs of facilities benefiting new development and those serving existing development.

- Identify new development to be served by Capital Improvements.

- Develop a reasonable cost allocation methodology that allocates costs to various land use categories (residential, commercial, office, industrial, etc.).

- Consider the addition of an administrative cost component for the annual administration of the fee program and costs of preparing the Nexus Study and future updates to the fee program.

It is highly recommended that special districts share the findings and results of the Nexus Study with cities or counties that must implement the fee program on behalf of the special district. At any time, a given special district fee will be just one of many development impact fees collected to fund infrastructure and facilities. Consideration of a special district’s fee will occur within the context of the suite of existing or proposed fee programs within a land use jurisdiction.

In a review of regional impact fees for the Sacramento area, a typical mix of impact fees by purpose or use is shown in the chart below. The percentages by purpose or use may vary by region in California.

Once a special district proposed fee program is vetted with enabling land use agencies, the development industry and other local stakeholders should be consulted before the adoption of a development impact fee program. A public hearing is required before the approval of a development impact fee program. Meeting with all stakeholders before the public hearing can assist the special district to identify and address any concerns before and at the public hearing.

Some Communitywide Considerations for Implementing Fees

Implementation of, or increases to, existing impact fees will cause initial economic impacts for the development community. A well-considered outreach program will help to alert the development community to potential impacts, giving them time to integrate the impact fee costs into the cost of new development. Some special districts have chosen to implement new impact fees incrementally over time to allow costs on the impact fees to be slowly integrated into the cost of new construction.

Some public agencies choose to not implement impact fees on certain types of new development (such as retail or industrial) to encourage economic development for job-inducing or revenue-inducing land uses. Other agencies suspend impact fee programs during economic downturns.

The costs of facilities included in impact fee programs must be allocated equitably to all benefiting land uses. If impact fees are increased over time, not collected for certain land uses, or suspended for a period of time, the “lost” impact fee revenues cannot be reallocated to other uses or future development. The public agency must acknowledge that such “lost” impact fee revenues will need to be replaced with other available agency funds, such as the General Fund.

Capacity for Infrastructure Financing

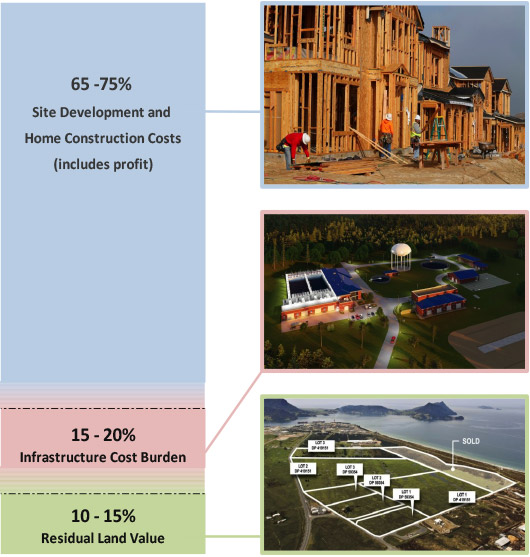

The illustration below identifies the typical cost components for a prototypical detached single-family residential unit. As shown, typically backbone infrastructure costs (many of which may be collected as development impact fees) range between approximately 10 and 20 percent of the total finished home sales value. In this most recent economic cycle, costs for backbone infrastructure have been steadily rising. Concurrently, most of the other cost components have also risen at equal or greater rates than infrastructure costs. In particular, the physical costs to construct residential dwelling units have increased at least 5 to 10 percent per annum in the last several years, depending on the types of infrastructure or facility.

An example of the typical spread of costs for single-family residential is shown in the following graphic.

The infrastructure cost burden of 15 to 20 percent includes impact fees.

As described below, in areas where cost escalation outpaces home price appreciation, additional pressure is exerted on infrastructure financing capacity and residual land values. Under these pressures, public agencies often prioritize their infrastructure needs into the following categories:

- Urgent infrastructure and facility needs.

- Critical (but not urgent) infrastructure and facility needs.

- Desirable infrastructure and facility needs.

Examples of infrastructure and facility needs that can be urgent or critical typically are driven by regulatory or environmental considerations, such as a new wastewater discharge permit, new storm water treatment standards, traffic mitigation measures, etc. Infrastructure such as community center, child care, and aquatics center facilities, or similar amenities can enhance the character, desirability, and attraction of a community; however, lack of these amenities does not jeopardize a community’s ability to meet basic infrastructure and other service provision needs.

Pressures on Impact Fees and Infrastructure Financing

Regulatory Pressures

The cost of infrastructure funded by impact fees can increase or change based on changes to regulatory policies enacted at the federal, state, or local level. As an example, increased wastewater discharge standards imposed by a Regional Water Quality Control Board can directly impact infrastructure needs at a wastewater treatment facility. Similarly, increased regulations related to storm water runoff, storage, and discharge can directly impact costs of storm drainage infrastructure. Special districts and other agencies responsible for such utility infrastructure may need to increase impact fees to offset the cost of improved infrastructure facilities. In fact, in many of these circumstances, agencies typically are compelled to update their capital improvement programs to comply with updated regulations or else risk losing their permits (e.g., wastewater discharge permits). Increased costs of capital improvements typically translate into increased impact fees for new users of the system.

Escalating Costs (Vertical Development and Infrastructure Costs)

In this prolonged economic cycle, the cost of housing construction in California has been under tremendous pressure from multiple sources. Shortages of construction labor have placed increasing pressures on labor costs while material prices have continued to escalate with increased demand. Construction labor shortages have been exacerbated recently by the very unfortunate loss of housing from natural disasters throughout the state. Increased regulations, such as mandatory fire sprinklers and the impending requirement for solar panel installation, have also played a major role in the cost of housing.

Cost Escalation Can Outpace Home Sales Price Changes

Excluding coastal markets and California’s major gateway cities, cost escalation has equaled or outpaced home sales price appreciation in recent years. When these conditions are present, the end result is a finite capacity for new residential development to shoulder infrastructure burdens, often in the form of development impact fees, at much higher levels than already exist in many jurisdictions.

Keeping up with the Joneses

While some impact fee increases are driven by an absolute need (i.e., in response to regulatory direction), other new fees or increases to fees can be driven by a desire to “keep up with the Joneses.” Impact fee programs may be developed that contain costly elements that provide enhanced stature for a community. While desirable, these elements also might be included in other communitywide efforts not specifically tied to new development.

In some cases, this desire may result in the imposition of development impact fees to fund infrastructure and other public facilities that are nice to have but not necessarily driven by a regulatory need. Improvements that may fall into this category include aquatics centers, equestrian centers, recreation and community centers, or other such large-scaled community facilities. Such facilities can serve to differentiate a community from its neighboring jurisdiction but can contribute to increased development impact fee burdens placed on new development.

Crowding Out

In many communities, increased home prices have crowded out many Californians from pursuing their dream of home ownership. Housing affordability has risen to one of the top priorities of the California legislature during each of the past two legislative sessions. While infrastructure cost burdens (i.e., impact fees) may represent less than one-fourth of the cost of new residential construction, all housing cost components are under scrutiny. As described earlier, given the general hierarchical nature of impact fee prioritization, impact fees typically funding infrastructure and public facilities for those special districts that provide non-fire, life safety, or water and wastewater services may be the ones most likely to be crowded out of the equation first.

When home price appreciation does not outpace costs required to produce housing, at a certain point, residual land values are insufficient to incentivize a land developer to undertake the cost, risk, and time it takes to entitle land for new development or redevelopment. From this standpoint, cities, counties, and special districts can be competing to capture a portion of the finite infrastructure financing capacity that can be borne by new development. Those agencies requiring infrastructure to provide urgent and critical services (public safety, public health, etc.) may crowd out other agencies that have less urgent infrastructure needs to provide their services.

Best Practices for Special DistrictsWhen embarking on new or updated development impact fees, special districts should consider the following best practices to set a course towards a successful fee implementation:

- Use of a well-documented capital improvement plan supported by current infrastructure or facility master plan documentation.

- Prioritization of capital improvement expenditures.

- Early and frequent outreach and coordination with local land use authorities (especially where such land use authority is needed to adopt fees on behalf of special districts).

- Identification of all capital improvement funding sources, and a distillation of net costs to be funded by development impact fees.

- Stakeholder outreach with affected parties throughout the Nexus Study preparation process.

- Awareness and consideration of total infrastructure cost burdens relative to finished real estate values.

- Consideration of infrastructure cost burdens of comparable jurisdictions.

- Consideration of comparable impact fees by capital improvement (e.g., park fee comparisons).

Best of luck addressing your capital facility needs using Mitigation Fee Act development impact fees!

#Finance

EDITORIAL CORRECTION: In the mailed print version of the July/August California Special Districts magazine, there was an error in the author byline on page 40 for the Money Matters article, “Impact Fees: Breaking New Ground Doesn’t Need to Break the Bank.” The correct author of this article is: Russell Powell, Senior Vice President, Economic & Planning Systems, Inc. (EPS). The digital version has been corrected.